Manage all your brokerage activities with ease

Our SaaS solution for brokers

You are a general broker, wholesale broker or specialist broker. You subscribe with or without underwriting delegation. iWE can provide you with a turnkey solution covering all your needs.

You will also have access to the policyholder, broker and insurer extranets.

You'll benefit from a large number of native : Docusign, EDI Courtage, SIREN, beneficial owners, online payment, etc.

Subscription features

Insurance claims management

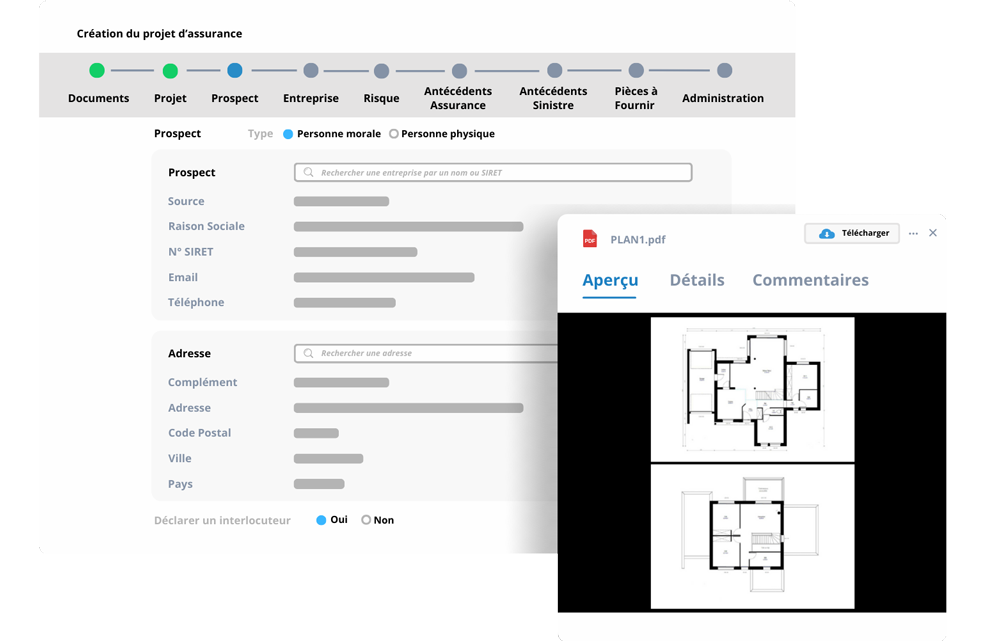

Manage your incoming requests.

The request can be created by the broker's back office or directly by the policyholder via their extranet if the necessary authorisations have been granted.

The processing of the request follows a process built around wizards that simplify and validate the input at each stage.

- Creation of the insurance project / description of the risk and target cover.

- Referral to insurers and/or direct quotation if underwriting delegated (mixed process possible).

- Follow-up of responses from insurers / personalised reminders.

- Recording and processing responses.

- Help with putting together the proposal.

- Sending the offer to the customer and follow-up.

- Discussions with the company and the potential contributor.

- Creation of the draft contract.

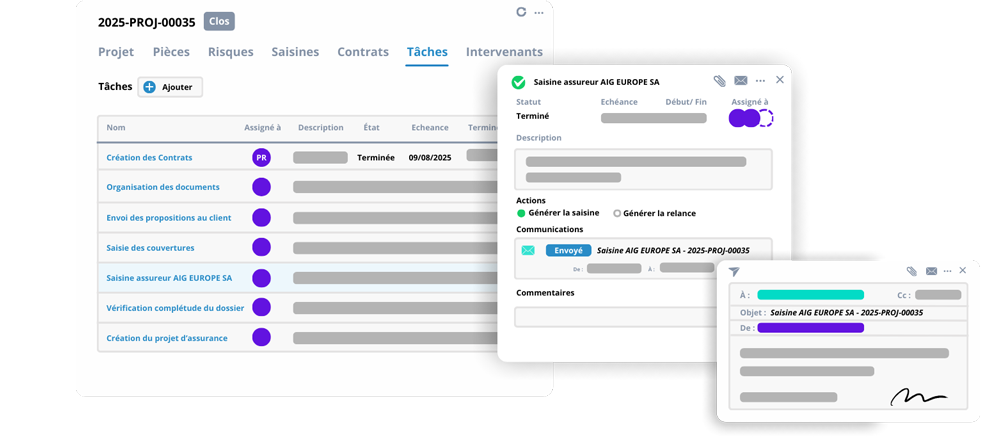

Contractualisation

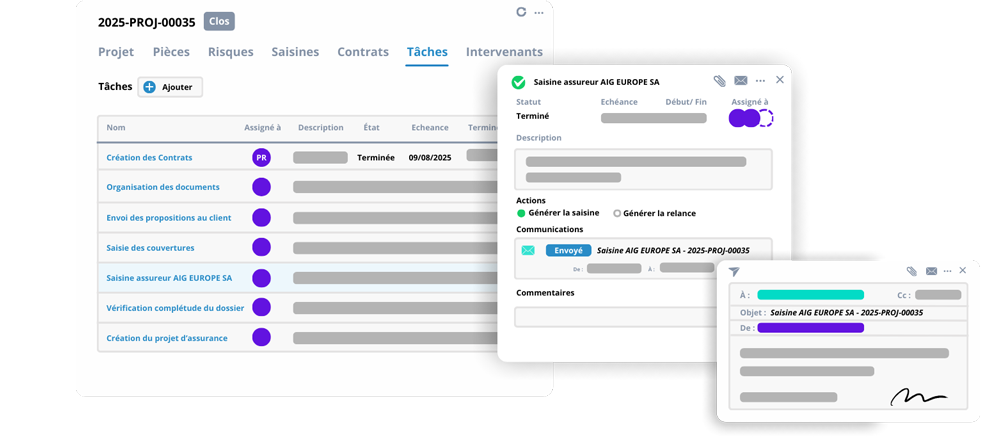

Simplify the creation and signing of contracts.

Process based on automatically created tasks associated with input wizards to guide the user

- The contract is sent to the policyholder for signature (Docusign electronic signature).

- Sending the signed contract to the company if no delegation.

- Recording of the essential elements making up the contract for final production of the contract.

Customer relationship management

Optimise your exchanges with your customers.

- Integration with the registry's Siren database, retrieval of essential data relating to prospects / Identification and management of duplicates.

- History of interactions with the customer: insurance applications, quotations sent, communications, contracts, claims, etc.

- Scheduling and management of appointments with customers. Automatic reminders for upcoming appointments.

- Customer qualification and segmentation.

- Creation of marketing campaigns.

- Integration with the INPI's database of beneficial owners.

Payment

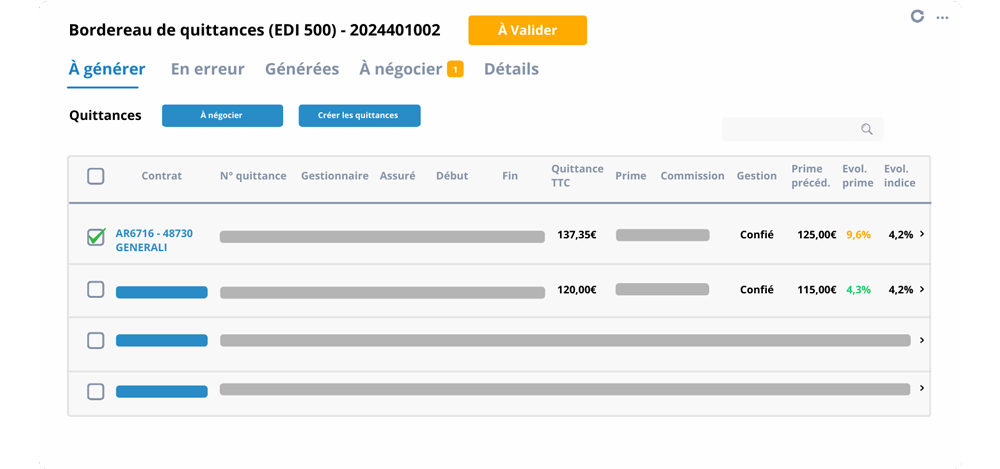

Automate the printing and tracking of your receipts.

- Assisted premium calculation (simulator): verification, recording of calculation bases, etc.

- Assisted entry form for company receipts.

- Generate receipt / add additional charges.

- Receipt sent by email / deposited on the policyholder extranet.

- Mass generation and dispatch of receipts.

Relations with policyholders

Get closer to your policyholders.

- Extranet with a home page tailored to your business.

- Claims reporting and follow-up.

- Receipts and unpaid bills.

- History of contracts / guarantees taken out.

- Declaration of new risks / insurance applications.

- Periodic declarations: sales, worksites, fleet status.

- Fleet management.

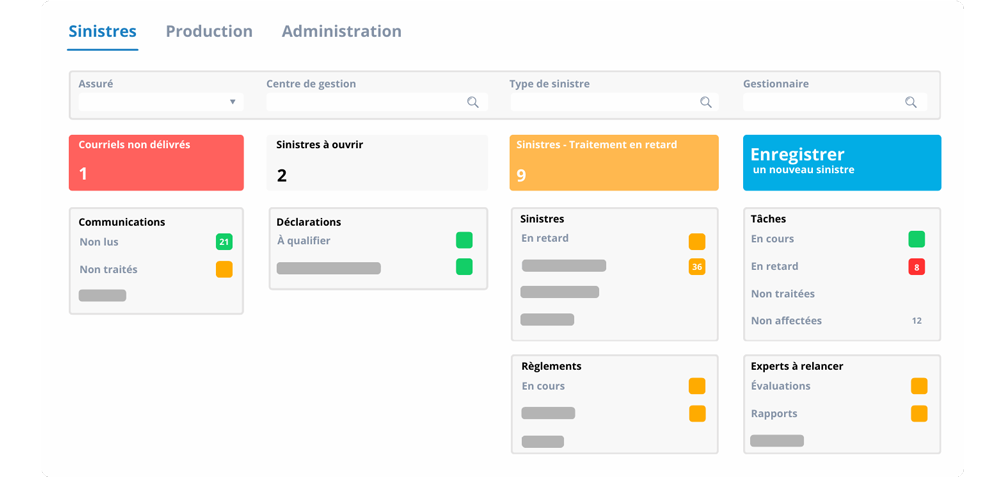

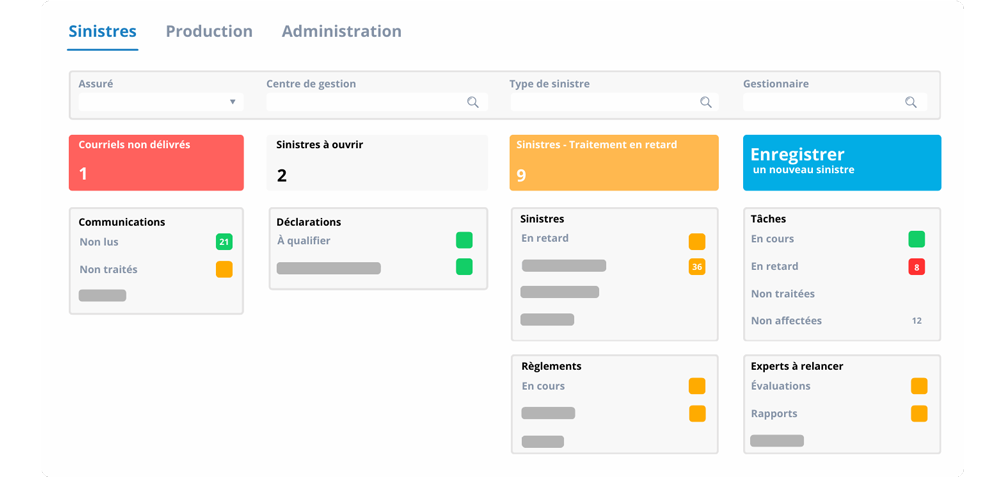

Claims management functions

Manage your claims effectively

- Creation of the insurance project / description of the risk and target cover.

- Referral to insurers and/or direct quotation if underwriting delegated (mixed process possible).

- Follow-up of responses from insurers / personalised reminders.

- Recording and processing responses.

- Help with putting together the proposal.

- Sending the offer to the customer and follow-up.

- Discussions with the company and the potential contributor.

- Creation of the draft contract.

Administration functions

Detailed description of insurance products

Simplify underwriting by detailing your complex products.

Several levels of product description, from the simplest to the most complex:

- Branch / Type of contract / Insurer / Cover / Formulas / Deductibles / Framework contract or not, etc.

- Delegation of management / Payment terms and conditions.

- Pricing.

Subscription delegation

Speed up your underwriting processes.

- Description of the scope of delegations granted.

- List of related products.

Font management

Centralise and track your insurance policies.

- Libraries of management actions specific to each type of contract. Each management act is associated with an input wizard to guide the user.

- Each management action can automatically lead to: requests for documents, calculation of an adjustment premium, issue of a new certificate, creation of an endorsement, etc., changes in the status of the contract or the risks covered.

- Existing management documents for: vehicle fleet, third-party liability, DAB, various fleets, structural damage, CMI, etc.

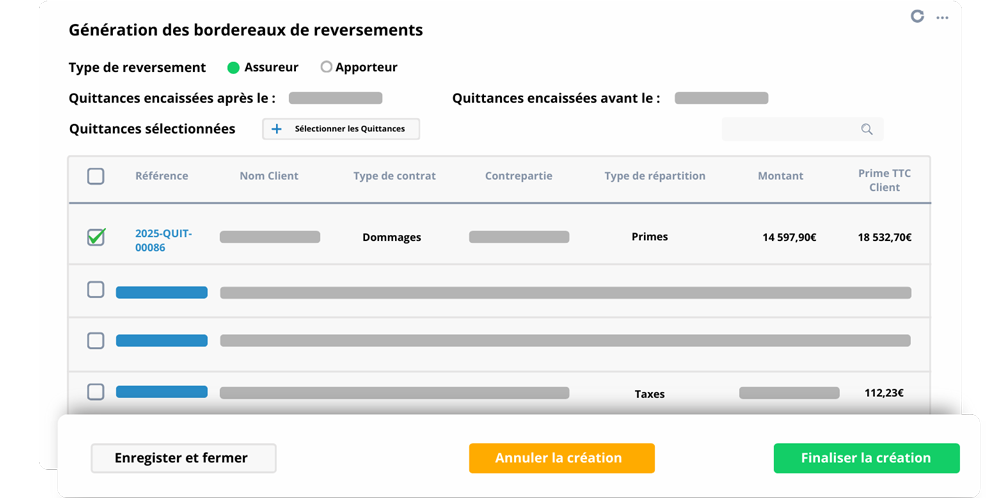

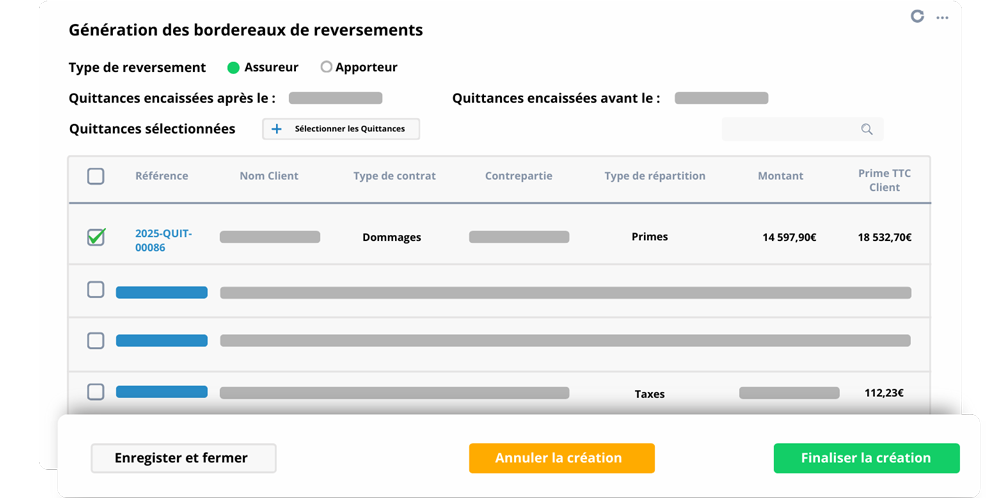

Relations with insurers and providers

Streamline your dealings with insurers.

- Insurer extranet.

- EDI brokerage flow.

- Transfer slips.

Optimise the management of your business partners.

- Supporter extranet.

- Automatic commission calculation.

- Follow-up of commission payments.

- Commission reports by agent or by period.

- Database of partners and insurance providers.

- Monitoring the performance of partners and commercial agreements.

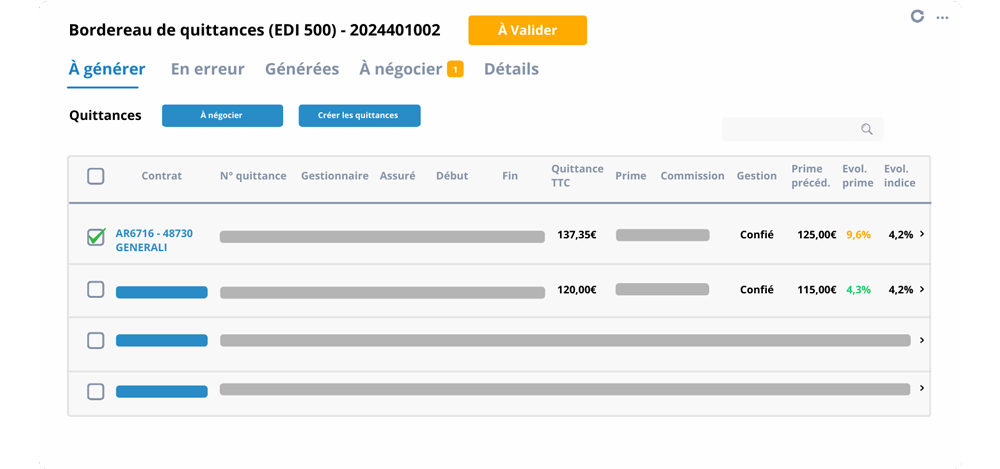

Renewal

Simplify the management of your renewals.

- Interface for analysing renewals transmitted by EDI Courtage.

- Automatic creation and dispatch of validated renewals, and negotiation of non-validated renewals.

- Integration of "paper" renewals (receipts and slips) via a dedicated interface (artificial intelligence) to avoid data entry.

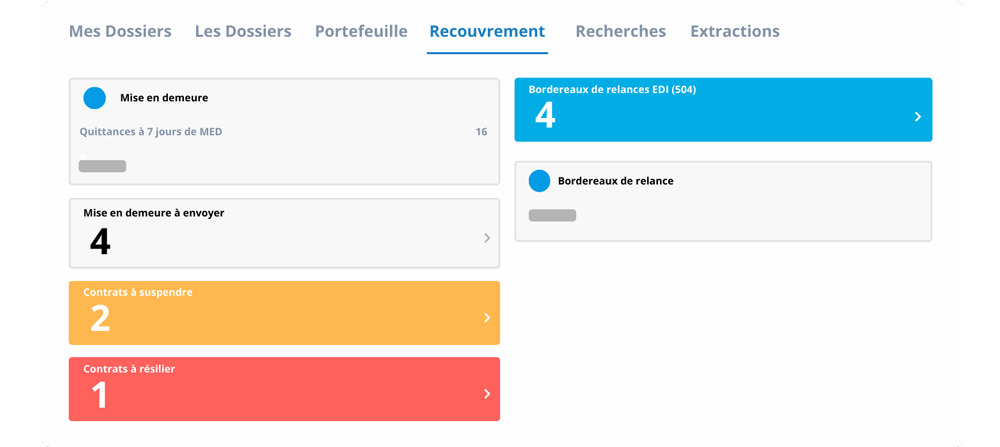

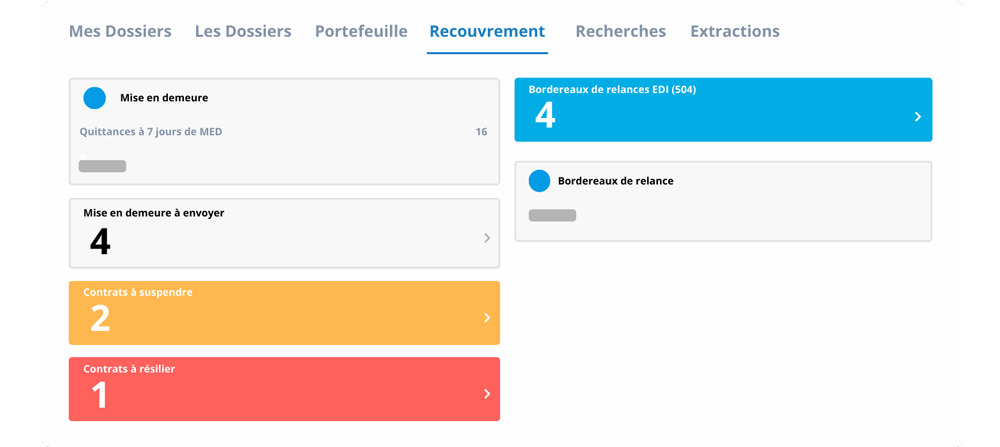

Tracking payments and cancellations

Monitor your payments and cancellations in real time.

- Dunning, suspension and termination conditions managed by product / delegation.

- Dashboard for managing unpaid debts.

- Integration with EDI Brokerage.

- Registered mail (integration).

Subscription features

Manage your incoming requests.

The request can be created by the broker's back office or directly by the policyholder via their extranet if the necessary authorisations have been granted.

The processing of the request follows a process built around wizards that simplify and validate the input at each stage.

- Creation of the insurance project / description of the risk and target cover.

- Referral to insurers and/or direct quotation if underwriting delegated (mixed process possible).

- Follow-up of responses from insurers / personalised reminders.

- Recording and processing responses.

- Help with putting together the proposal.

- Sending the offer to the customer and follow-up.

- Discussions with the company and the potential contributor.

- Creation of the draft contract.

Simplify the creation and signing of contracts.

Process based on automatically created tasks associated with input wizards to guide the user

- The contract is sent to the policyholder for signature (Docusign electronic signature).

- Sending the signed contract to the company if no delegation.

- Recording of the essential elements making up the contract for final production of the contract.

Optimise your exchanges with your customers.

- Integration with the registry's Siren database, retrieval of essential data relating to prospects / Identification and management of duplicates.

- History of interactions with the customer: insurance applications, quotations sent, communications, contracts, claims, etc.

- Scheduling and management of appointments with customers. Automatic reminders for upcoming appointments.

- Customer qualification and segmentation.

- Creation of marketing campaigns.

- Integration with the INPI's database of beneficial owners.

Automate the printing and tracking of your receipts.

- Assisted premium calculation (simulator): verification, recording of calculation bases, etc.

- Assisted entry form for company receipts.

- Generate receipt / add additional charges.

- Receipt sent by email / deposited on the policyholder extranet.

- Mass generation and dispatch of receipts.

Get closer to your policyholders.

- Extranet with a home page tailored to your business.

- Claims reporting and follow-up.

- Receipts and unpaid bills.

- History of contracts / guarantees taken out.

- Declaration of new risks / insurance applications.

- Periodic declarations: sales, worksites, fleet status.

- Fleet management.

Claims management functions

Manage your claims efficiently.

- Creation of the insurance project / description of the risk and target cover.

- Referral to insurers and/or direct quotation if underwriting delegated (mixed process possible).

- Follow-up of responses from insurers / personalised reminders.

- Recording and processing responses.

- Help with putting together the proposal.

- Sending the offer to the customer and follow-up.

- Discussions with the company and the potential contributor.

- Creation of the draft contract.

Administration functions

Simplify underwriting by detailing your complex products.

Several levels of product description, from the simplest to the most complex:

- Branch / Type of contract / Insurer / Cover / Formulas / Deductibles / Framework contract or not, etc.

- Delegation of management / Payment terms and conditions.

- Pricing.

Speed up your underwriting processes.

- Description of the scope of delegations granted.

- List of related products.

Centralise and track your insurance policies.

- Libraries of management actions specific to each type of contract. Each management act is associated with an input wizard to guide the user.

- Each management action can automatically lead to: requests for documents, calculation of an adjustment premium, issue of a new certificate, creation of an endorsement, etc., changes in the status of the contract or the risks covered.

- Existing management documents for: vehicle fleet, third-party liability, DAB, various fleets, structural damage, CMI, etc.

Streamline your dealings with insurers.

- Insurer extranet.

- EDI brokerage flow.

- Transfer slips.

Optimise the management of your business partners.

- Supporter extranet.

- Automatic commission calculation.

- Follow-up of commission payments.

- Commission reports by agent or by period.

- Database of partners and insurance providers.

- Monitoring the performance of partners and commercial agreements.

Simplify the management of your renewals.

- Interface for analysing renewals transmitted by EDI Courtage.

- Automatic creation and dispatch of validated renewals, and negotiation of non-validated renewals.

- Integration of "paper" renewals (receipts and slips) via a dedicated interface (artificial intelligence) to avoid data entry.

Monitor your payments and cancellations in real time.

- Dunning, suspension and termination conditions managed by product / delegation.

- Dashboard for managing unpaid debts.

- Integration with EDI Brokerage.

- Registered mail (integration).

They have transformed their business with our collaborative SaaS solutions

Step up a gear today

Discover how our solution can simplify your processes, boost your productivity and reduce your costs right out of the box.